Settlement costs will be the number you will want near the top of your own down payment to find property. MoMo Productions/Getty Pictures

- Wisdom closing costs

- Overview of average settlement costs

- Products influencing settlement costs

- Ideas on how to guess the closing costs

Member backlinks for the things on this page come from partners that compensate united states (get a hold of our marketer disclosure with the help of our selection of couples for lots more details). not, our very own opinions is our personal. Observe we rates mortgages to enter unbiased studies.

- Financial closing costs usually start from dos% to six% of one’s amount borrowed.

- They are able to are very different widely of the bank and venue.

- You will find some a way to decrease your settlement costs while making the loan cheaper.

Settlement costs are one of the a couple significant initial expenditures you are able to need certainly to safeguards when purchasing a house. Although the actual amount you can shell out may differ a little a beneficial part, you could potentially fundamentally expect to pay somewhere between 2% and you may 6% of the complete amount borrowed.

That would add up to as much as $6,600 to help you $20,000 towards a median-charged domestic (based on Redfin study regarding the next quarter of 2024). That is plus a good 20% downpayment away from $82,460

Insights settlement costs

Settlement costs is actually a major expenses to adopt when looking for home financing otherwise given purchasing property. Their closing costs can add rather toward number you desire to order a home, and they are an amount which is independent out of your down-payment.

Just what are closing costs?

Closing costs put this new charges you bear from inside the processes of getting a mortgage. They are able to include things like the mortgage lender’s origination fees, the latest assessment you have got towards the home, or perhaps the price of taking a title research. Settlement costs are incredibly named because it is possible to spend such can cost you during the the closure of your loan.

What makes settlement costs required?

Settlement costs compensate the different third parties doing work in your house buy otherwise http://elitecashadvance.com/installment-loans-pa/oakland refinance – the financial, real estate agent, appraiser, surveyor, and more. Nevertheless they pay for things like the HOA dues, assets taxation, home insurance, or any other needed costs from homeownership.

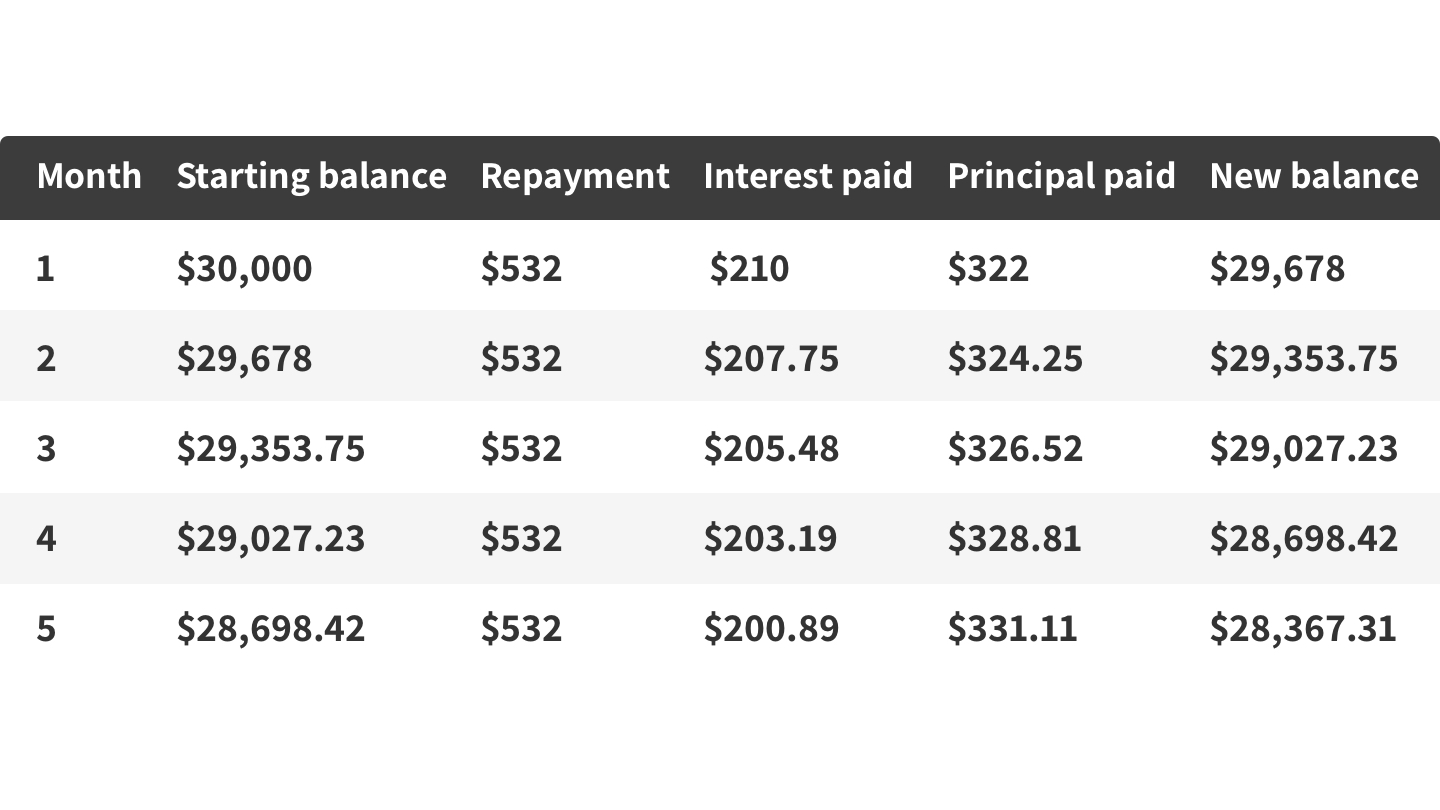

You’ll score a loan in the place of closing costs, however, often, the costs roll to your longevity of the mortgage. You could find you to financing that have down if any closure costs has a high financial interest rate, which could make costs greater than simply paying up front. A lender might create closing costs on loan’s dominant, hence advances the complete count you’ll pay notice on the.

Closing costs try reduced to a few of your own agencies that will you finish the homebuying processes and you can close on your house. Here is a closing prices dysfunction, with respect to the Federal Put aside.

Loan origination costs

The majority of your own closing costs will go on the your financial. It is often an enthusiastic origination percentage from 0% to 1.5% of loan amount that goes toward the newest lender’s costs off underwriting and you will making preparations your own mortgage, as well as other financial-front fees, such a loan application percentage ($75 so you’re able to $300), credit history fee, (doing $30), and a lot more.

Appraisal and you may assessment costs

Your own financial tend to purchase an appraisal to guarantee the residence is well worth at the very least the amount of the loan. This normally can cost you ranging from $3 hundred so you’re able to $700, depending on where you’re receive. You may want to possess most review charges (such as for example insect monitors, for instance).

Identity insurance policies and you can payment fees

Lenders enjoys a concept business work with a browse brand new house’s label to help you find out if owner ‘s the assets proprietor and that this new term does not have any one liens involved. Loan providers generally speaking require consumers to order good lender’s identity insurance coverage too, and that covers the lending company when the title factors come right up afterwards. If you want so it defense on your own, you will need pick an owner’s identity insurance plan. Anticipate paying up to $700 to $900 for the label attributes.