As your leading mortgage broker, you will find accessibility a diverse circle regarding legitimate lenders inside Atlanta. This enables us to provide you with a wide range of financial options customized toward finances and tastes. Whether you are seeking to a conventional loan, government-recognized loan, otherwise certified system, The Home loan Man gets the expertise to discover the primary fit to you personally.

Personalized Home loan Choices during the Atlanta GA

We understand that each consumer’s financial predicament is different. We at the Home loan Guy takes the time to pay attention and you can see your position, making certain we make available to you home loan selection one fall into line along with your long-title objectives. Our very own objective is to try to secure the very favorable terms and you can attention rates, designed especially for you.

Streamlining the loan Procedure inside Atlanta

Navigating the mortgage processes within the Atlanta might be challenging, but with Their Financial People with you, it becomes a flaccid excursion. I deal with all the records and you can communicate with lenders into your own behalf, saving you persistence. The masters often direct you through the software procedure, bringing reputation and you can reacting any queries you have got across the means.

Your neighborhood Atlanta A residential property Advisor

Atlanta is actually a city of brilliant areas, for every single using its own novel profile and lifestyle. Because a community large financial company, i’ve a deep knowledge of the latest Atlanta housing market. Whether you are looking for brand new active urban lifetime of Midtown, the newest historical attraction regarding Virginia-Highland, and/or family members-friendly suburbs, Your own Financial People offer rewarding information to help you create advised conclusion.

Pro Guidance, Respected Results

At your Financial Man, i pride our selves towards delivering pro recommendations and transparent communications through the their financial journey. We want that be pretty sure and you may told at every step of one’s processes. We is definitely offered to target your questions and provide rewarding advice, making certain you create an educated conclusion for your upcoming domestic.

Speak to your Financial People Today!

Happy to take the initial step to the homeownership within the Atlanta, GA https://paydayloansconnecticut.com/heritage-village? Contact your Home loan People right now to schedule a consultation which have one of your experienced mortgage benefits. Why don’t we be your top partner with this enjoyable journey, and you will to one another, we shall open the doors to the fantasy household.

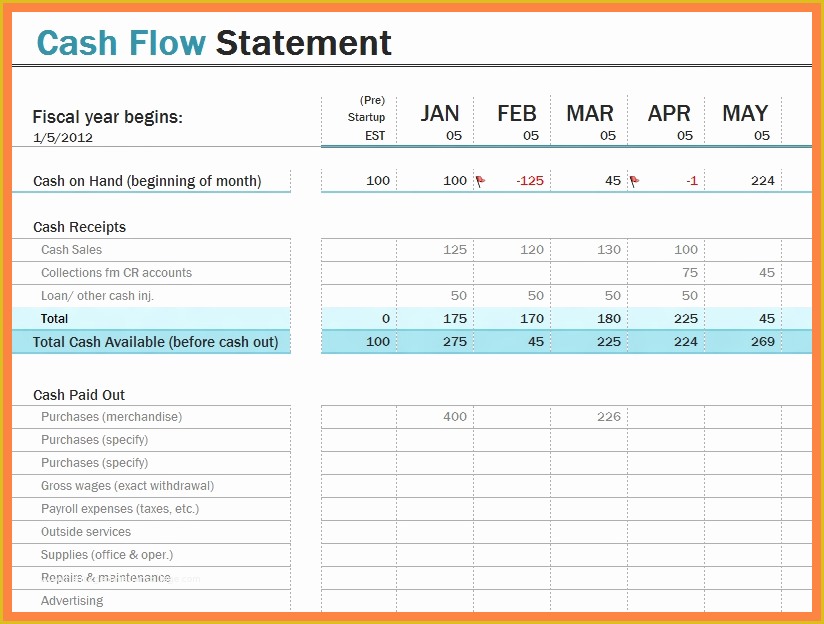

You prefer investment selection for the a house, or any other home? Going for a buy loan merchandise that suits your goals and you can and come up with yes you get an educated speed to suit your provided scenario can also be feel just like to relax and play strike-a-mole.

We’re here to make the home loan process a whole lot easier, with tools and expertise that will help guide you along the way, starting with a FREE pre-approval letter consult.

We will make it easier to clearly get a hold of differences between financing applications, enabling you to select the right choice for you whether you are an initial-day house customer otherwise a seasoned trader.

- Complete our simple mortgage pre-approval page demand

- Located alternatives based on your unique conditions and you will circumstance

- Compare mortgage interest levels and words

- Find the offer that best fits your circumstances

Would I Meet the requirements?

To qualify for home financing, loan providers generally require you to keeps a personal debt-to-income proportion away from . This is why only about 43% of one’s total month-to-month income (away from the present, just before taxation) may go for the your brand-new mortgage payment, without over % of one’s monthly income can go to your the total month-to-month financial obligation (as well as your mortgage payment).

*Rates and you will APRs cited more than are for manager-occupied properties, minimum 780 credit score, maximum ninety% loan-to-really worth proportion, maximum thirty-six% debt-to-income proportion. Items such as for example occupancy, credit history, loan-to-really worth proportion and you may personal debt-to-income proportion make a difference your own real interest rate. Most of the condition varies. Delight consult a Registered Financial Advisers for a beneficial quote particular with the products. Maximum amount borrowed are $795,000. Example repayments predicated on an excellent $250,000 transformation price and good $200,000 loan amount.