If you are looking to simply help a good 1099 company buyer secure a great home loan, you need to learn their finances. Even though an excellent 1099 consumer’s criteria to own approval are like people out-of a traditional W-dos customer, the process is often a whole lot more strict. Including, their 1099 visitors will have to give several years’ value of files (elizabeth.grams., cash flow statements, income tax documents, proof work stability). Financing officials have to be acquainted with just what such members deal with and you may capable provide solutions to assist them to successfully navigate its home loan financing travels.

Understanding the 1099 contractor landscaping.

An effective 1099 contractor, also referred to as a different specialist, is a type of worry about-functioning staff exactly who constantly brings attributes to help you businesses or readers on an agreement foundation. The fresh 1099 refers to the Irs tax setting these gurus have to have fun with to help you claim the earningsmon professions in which you can find 1099 contractors are freelance creatives (e.g., editors, writers and singers, performers), doctors/dentists, and you may real estate professionals.

Just like any a career particular, there are positives and negatives to being get a loan with bad credit Shoal Creek AL a great 1099 specialist. They often times enjoy the freedom of getting control of their own schedule and ideas. According to field, 1099 builders also have the potential for large earnings since they negotiate their unique cost. They’re able to together with benefit from some taxation deductions pertaining to providers expenditures, which will surely help lose the nonexempt earnings.

There are numerous disadvantages, too. This type of gurus typically do not located professionals, instance health insurance and retirement plans, including W-dos personnel create. Also, they are guilty of using thinking-work fees along with personal protection and you may Medicare. Even the most significant drawback is that the earnings can often be erratic as they can fluctuate anywhere between periods of being from inside the large request and you will episodes having simple potential.

Challenges 1099 contractors face into the acquiring home financing.

Getting a mortgage while the a beneficial 1099 contractor can expose multiple challenges as compared to old-fashioned W-2 team. MLOs would be ready to give advisory suggestions on the 1099 subscribers throughout the these types of pressures in the mortgage software procedure.

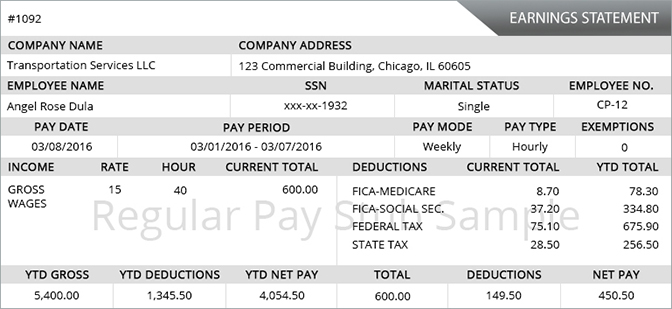

- Income Confirmation. A significant part of your financial procedure is providing reported research cash. While the 1099 builders don’t get W-dos, this is exactly complex due to income motion seasons more year. In which old-fashioned team is also fill in W-2s and you can salary stubs, 1099 designers will require tax statements, profit/losses statements, and you may lender comments to ensure its earnings background.

- Work Confirmation. Lenders always request at the least couple of years out of steady a position, thus designers who work to your a project-by-venture foundation may have challenge exhibiting consistent a career. Therefore, loan providers may prefer to select several years of care about-employment history to show balances.

- Debt-to-Money Ratio. A borrower’s DTI is sometimes thought by the loan providers to choose exactly how much of a home loan they may be able pay for within the believe of its other expenses. Both, having contractors that have unusual money, DTI computation are going to be difficult.

- Improved Scrutiny. A portion of the financial processes is determining exposure, which includes brand new personal analysis out of a good borrower’s monetary profile from the a keen underwriter. Builders will get face much more strict requirements, eg a top credit score or rate of interest, and then make right up for a thought increased chance.

- Mortgage System Limitations. Some financing programs, including authorities-supported loans, have income confirmation conditions one to contractors are able to find problematic. Such as, they may prioritize consumers who’ve consistent income info.

Just how MLOs assist its 1099 members address home loan challenges.

Mortgage officers would be familiar with the potential obstacles the 1099 specialist readers commonly face. By the knowing the nuances of each of your own following the popular pressures, MLOs gets a less complicated day tailoring their method of bring an educated service to their website subscribers.