The primary role away from a chapter eight trustee into the a secured item situation should be to liquidate the fresh debtor’s taxable property you might say that increases the brand new return to the latest debtor’s unsecured loan providers. The brand new trustee accomplishes that it of the attempting to sell new debtor’s possessions when it is free of charge and free from liens (provided the house isnt excused) or if it is value more than one safeguards attention or lien connected to the possessions and you will people exception to this rule that the debtor retains from the property. ” The latest trustee’s to stop powers include the capability to: arranged preferential transmits designed to loan providers in this ninety days just before the petition; undo coverage welfare and other prepetition transfers out of possessions that have been not properly learned significantly less than nonbankruptcy rules at the time of the latest petition; and you can pursue nonbankruptcy says including fraudulent conveyance and majority transfer remedies available less than condition laws. Concurrently, if the borrower is a corporate, the bankruptcy proceeding judge can get approve the latest trustee to operate the firm to own a limited time period, when the instance procedure can benefit creditors and you will boost the liquidation out of new house. 11 You.S.C. 721.

Point 726 of Personal bankruptcy Code controls the distribution of your assets of property. Significantly less than 726, there are half dozen kinds from states; each classification need to be paid-in complete until the 2nd straight down class is paid down something. The fresh borrower is just paid off if the virtually any categories off says was in fact paid-in full. Accordingly, the new debtor isnt particularly finding brand new trustee’s feeling regarding the fresh home assets, but according to payment of those debts hence to possess some need commonly dischargeable on case of bankruptcy situation. Anyone debtor’s number one questions from inside the a section 7 case are to retain excused possessions and discover a release which covers as many costs to.

Brand new A bankruptcy proceeding Launch

A release launches private debtors away from private accountability for many bills and you may inhibits the fresh creditors due people expense regarding delivering one range strategies contrary to the debtor. Because the a chapter seven discharge is subject to of a lot exceptions, debtors will be consult skilled legal services prior to filing to go over the fresh new extent of the launch. Essentially, leaving out circumstances that are dismissed otherwise translated, individual debtors discover a discharge in more than just 99 per cent away from a bankruptcy proceeding circumstances. In most cases, unless of course an event in the attention data a problem objecting into the discharge or a movement to increase the full time to help you object, the fresh new bankruptcy legal will matter a discharge buy apparently at the beginning of the actual situation essentially, 60 so you can 3 months following time very first in for the new appointment away from loan providers. Given. Roentgen. Bankr. P. 4004(c).

The grounds to have doubt just one borrower a release for the a chapter 7 circumstances are narrow and are usually construed contrary to the moving people. Certainly almost every other grounds, the brand new judge may refuse the new borrower a release when it finds your debtor: don’t keep otherwise produce adequate guides otherwise monetary information; didn’t determine satisfactorily one loss of assets; committed a case of bankruptcy Eagle installment loans no bank account crime eg perjury; didn’t obey a legal buy of your own personal bankruptcy legal; fraudulently transported, concealed, or destroyed property who would are very possessions of your estate; otherwise did not complete an approved instructional course about the economic management. 11 U.S.C. 727; Fed. R. Bankr. P. 4005.

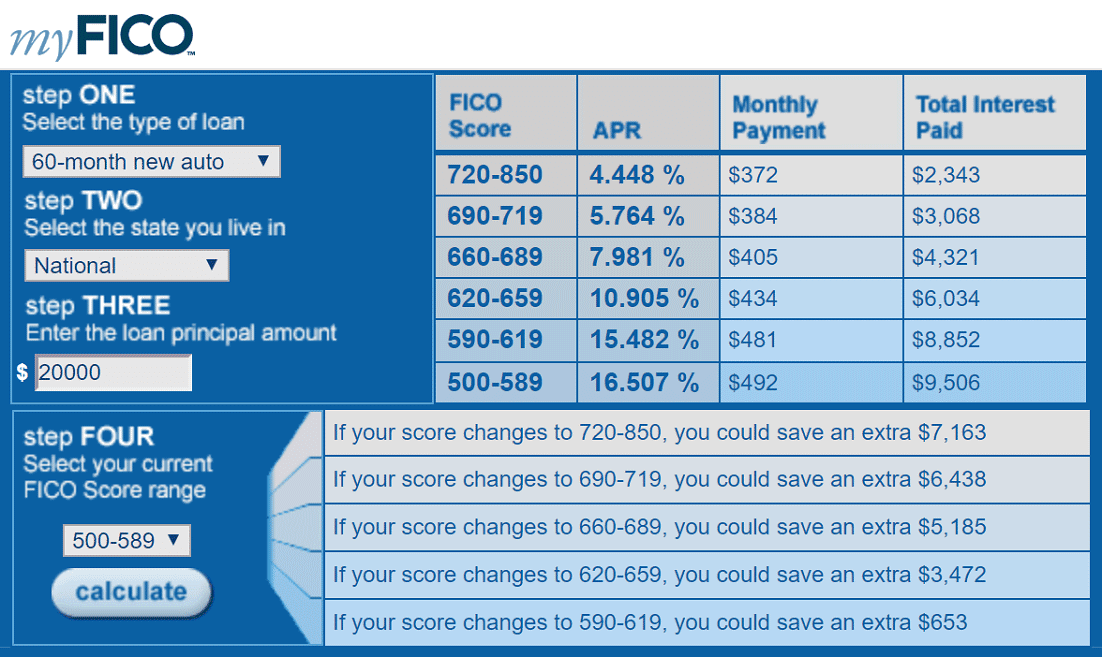

Safeguarded financial institutions can get keep particular legal rights to seize assets securing an enthusiastic fundamental debt despite a release is supplied. Based personal factors, if a debtor wishes to keep specific protected assets (such as for example a motor vehicle), he or she might wish to “reaffirm” the debt. A reaffirmation is actually a contract within borrower while the collector your borrower will remain responsible and will pay-all or a portion of the bad debts, although the debt do if you don’t getting discharged regarding the personal bankruptcy. Reciprocally, the fresh collector guarantees that it will perhaps not repossess or take straight back the automobile and other possessions so long as the new debtor continues on to spend the debt.

During the a chapter 7 circumstances, not, a discharge is only available to individual debtors, to not ever partnerships otherwise providers

One of the first reason for case of bankruptcy is to try to launch certain debts supply a genuine private debtor good “new start.” Brand new borrower has no responsibility for discharged bills. 11 U.S.C. 727(a)(1). No matter if just one chapter 7 instance always results in a discharge away from debts, the legal right to a discharge isnt pure, and many particular expenses commonly discharged. Furthermore, a bankruptcy proceeding discharge does not extinguish a beneficial lien towards the property.

One of several schedules that a single debtor have a tendency to document try good schedule from “exempt” assets. The fresh Case of bankruptcy Password lets one borrower (4) to protect specific assets throughout the claims of loan providers because it is excused significantly less than federal bankruptcy proceeding laws otherwise according to the guidelines regarding the fresh debtor’s family state. eleven You.S.C. 522(b). Many states have chosen to take benefit of a provision regarding Personal bankruptcy Password that permits for every county to take on its exclusion rules in the place of the fresh government exemptions. In other jurisdictions, the individual debtor contains the accessibility to choosing between a federal bundle out-of exemptions or even the exemptions offered lower than state laws. Hence, whether or not specific house is exempt that will getting remaining of the borrower is frequently an issue of county legislation. This new borrower is consult a lawyer to choose the exemptions readily available regarding condition in which the borrower life.

Beginning out of a personal bankruptcy situation creates an “home.” The brand new property technically becomes new temporary judge proprietor of the many debtor’s assets. It include every judge or fair appeal of your own debtor from inside the assets as of the beginning of circumstances, as well as possessions had otherwise kept because of the another individual in case your debtor has an interest on the property. Normally, the brand new debtor’s financial institutions are paid regarding nonexempt possessions of one’s property.