To order an alternate residence is a super fascinating and you may super hectic go out. There are many different details and decisions working in so it purchase and you can, needless to say, many costs. A routine homebuyer, according to sorts of the loan and other facts, you’ll expect to pay ranging from 2-5% of your cost to possess closing costs. So you can get ready, let me reveal specific helpful suggestions regarding charges you can expect so you can shell out at the closing.

Exactly what do closing costs mean?

Closing costs are the costs and you will costs sustained to have commercially moving a home from a single holder to another. The procedure is complicated and requires type in out of many third party positives. Your own settlement costs help security the work of those gurus, also specific regional taxation and you will charges.

There’s absolutely no solitary treatment for the question out-of simply how much closing costs would-be, nonetheless they usually start around 2 % and you will 5 % off the property value. The last amount depends on local regulations and you can taxes, this service membership charges of your gurus put, individuals situations of your house and possessions and the lender you like. The settlement costs must not become while the a surprise to you personally with the closing day. We will present an effective “mortgage guess” or a detailed listing of their anticipated settlement costs, within this three days of your own mortgage app.

What type of charge can i expect within my personal closing costs?

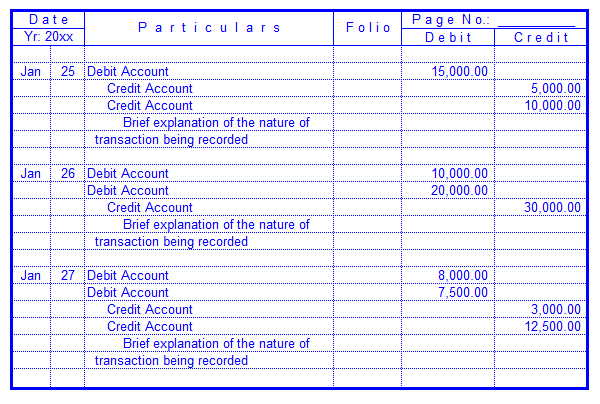

For every single bank may deal with its charge otherwise will set you back differently. Specific loan providers plan everything towards the an origination commission, although some split things out. Whilst each home loan is exclusive, you are going to understand the after the fees can be found in their guess from Selfreliance FCU:

- Lender fees: creditors tend to generally costs an enthusiastic origination commission (on average, throughout the step 1% of your own full mortgage) and a one day application percentage (constantly to how many installment loans can you have in Illinois $300) into the mortgage acceptance process. On Selfreliance FCU, i waive all origination charges, and expect to pay two or three minutes reduced than along with other lenders (relate to take to comparison lower than).

- Assessment charges: reduced in order to a professional possessions appraiser getting assessing brand new residence’s fair market value.

- Term charges: coverage a concept browse, insurance rates, and you can payment

- Transfer fees: shelter mobile the brand new identity from the supplier into the client.

- Escrow deposit: we’re going to carry out an escrow membership to make sure you’ve got the money available to pay repeating costs such as for instance assets taxes and homeowner’s insurance rates afterwards. At the closing, you will be anticipated to vegetables that membership that have upwards-front dollars.

- Home loan insurance costs: for a traditional financial with less than 20% advance payment, we would require private mortgage insurance coverage and commission of the very first month’s superior from the closure.

- Prepaid notice: Homebuyers can get to expend the attention into the first month’s homeloan payment in the closing.

Although you are unable to stop to expend alternative party fees, such as for instance name costs, attorney’s charges, or even the appraisal fees, you can and may seek advice about the charges that the bank may charge to have handling your home loan. At the Selfreliance FCU, we always display our competitors and gives the members that have good reduced bank fee. Search oneself, the latest computations are derived from property worth of $250,000:

According to site advice away from regional financial institutions with the to have a great top quarters re-finance which have LTV 80%. Identity, tape, or any other charges will get apply

*Mortgage loans readily available simply for the following owner-occupied qualities: single family relations homes, accredited condominiums otherwise multiple-nearest and dearest structures no over five units or over so you’re able to 80% LTV. Mortgages which have off repayments as little as 5% (doing 95% LTV) appear only for the second owner-filled qualities: solitary family unit members land and you may multiple-nearest and dearest structures as much as 2 equipment and will require personal home loan insurance coverage (PMI). At the mercy of recognition of app. The latest said Yearly Percentage Pricing (APRs) are all according to $100,000 mortgage loans, apart from the fresh new Repaired Price Jumbo Collection Mortgage loans being depending for the $726,two hundred mortgage loans. Eg, an excellent $100,000 30 Season Repaired Speed Buy financial which have a keen 80% LTV are certain to get an effective 6.134% Annual percentage rate in addition to repayment schedule would be 360 monthly installments regarding approximately $599. Payment amount doesn’t come with people property taxation, and/or insurance fees; the real payment might possibly be deeper whenever particularly items are incorporated. Mortgages offered merely to members and just in the designated geographic places. Every Selfreliance FCU loan apps, rates, small print try subject to alter when as opposed to observe. Not all the individuals have a tendency to be eligible for a reduced Yearly Commission Costs (APR) shown. Apr (APR) is founded on an assessment out-of individual creditworthiness, occupancy and you can/or assets method of, and you can all of our underwriting criteria. Delight call all of our financial company toll-free within step one.x283 to have newest now offers, costs and you will terminology.