1. Goal

HELOCs is revolving, and generally low-amortized, borrowing issues covered of the a good lien to the borrower’s homes. Footnote step 1 The latest HELOC product basic appeared in the fresh new late seventies, nevertheless try for the middle-90s one lenders first started creating HELOCs to appeal to a wide cross-element of consumers. Now, most HELOCs can be purchased because the an element of readvanceable mortgage loans. Readvanceable mortgages blend HELOCs that have amortized mortgages, and perhaps almost every other credit services banking functions (age.g., personal loans, business loans, chequing account, overdraft safeguards and you may playing cards) lower than an international borrowing limit shielded by the a guarantee charge against the new borrower’s possessions.

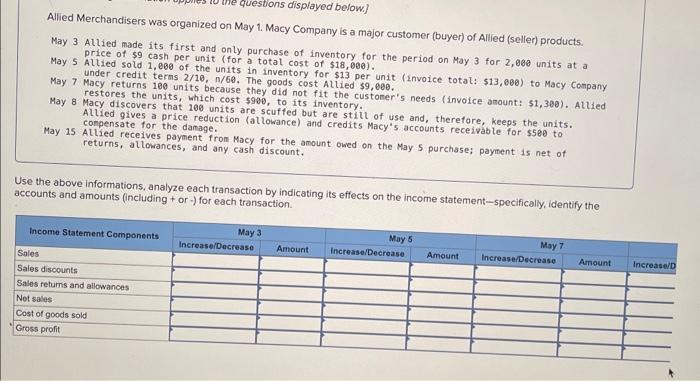

Profile step 1: Types of readvanceable financial items

Lender away from Montreal: Resident Readiline Lender from Nova Scotia: Scotia Complete Equity Bundle (STEP) Canadian Imperial Lender regarding Commerce: CIBC House Energy Package Manulife Lender: Manulife One to Mortgage Federal Financial out-of Canada: All-in-You to Account Royal Bank away from Canada: RBC Homeline Plan Toronto-Rule Lender: TD Family Collateral FlexLine

Fast extension: 20002010

The brand new HELOC s. HELOC balances grew regarding up to $thirty five million inside 2000 so you’re able to up to americash loans Beaverton $186 million because of the 2010, to possess the average yearly rate of growth of 20%. During this time period, HELOCs came up as the biggest and more than important sorts of non-financial unsecured debt, broadening out-of merely over 10 percent away from low-home loan consumer debt for the 2000 to nearly 40 percent from low-home loan consumer debt this present year. In comparison, playing cards has constantly represented as much as 15 per cent out-of non-home loan unsecured debt. Footnote dos

It quick extension was passionate generally by the low interest rates and you may ascending house pricing. The latest long-period from suffered grows from the cost of residential a home, and this began during the early 2000s, managed to make it more relaxing for users to utilize their house guarantee as the equity to own protected personal lines of credit. Unit innovation, high investments during the deals and you may beneficial credit conditions as well as aided strength the development of one’s HELOC sector. Users borrowed up against their residence equity in order to combine debt, loans domestic home improvements, funds getaways and buy larger-solution points such as automobiles, leasing properties, cottages and you can monetary assets (elizabeth.grams., securities), having fun with leveraged investment methods (look for Figure 2). Footnote step 3

Contour dos: HELOC uses 19992010

Consumption and you will domestic restoration: 40% Economic and you can non-investment: 34% Debt consolidation reduction: 26% Source: Canadian Monetary Monitor additionally the Financial regarding Canada

This new increasing interest in HELOCs into the 2000s was an essential rider behind the newest expansion out of family personal debt. In the past, personal debt and you may domestic income had enhanced within a similar rate and you will the brand new proportion between them is actually apparently steady. In the 2000, Canadian domiciles due on the $step 1.07 for each dollar from throw away income. By 2010, the latest proportion out-of debt so you can throw away money had risen up to $step 1.sixty. Profile 3 (below) implies that the latest HELOC boom coincided for the good extension regarding house personal debt. Specific replacing did take place, that have customers playing with HELOCs unlike other, higher-prices borrowing points (e.g., playing cards, installment loans). Footnote 4 Total, although not, broadening HELOC balances led to a more impressive expansion out-of credit rating than would have otherwise took place. Footnote 5 Footnote

Average increases: 2011now

The growth of your HELOC markets stabilized throughout the years adopting the the newest recession. The common annual development slowed down to help you 5 % ranging from 2011 and you may 2013 and has now averaged 2 percent within the last numerous ages. A good HELOC balances reached $211 million for the 2016. Footnote 6 There are just as much as step three billion HELOC account in Canada, that have the typical a fantastic balance out-of $70,000. The fresh reasonable development seen over the past ten years will likely be attributed to this new steady decline out of consult, race off lowest-desire antique mortgage loans, therefore the introduction of the newest guidelines and you will direction.